Finally an Easy Way to Apply for ObamaCare

November 13, 2013 By Katie Banks+

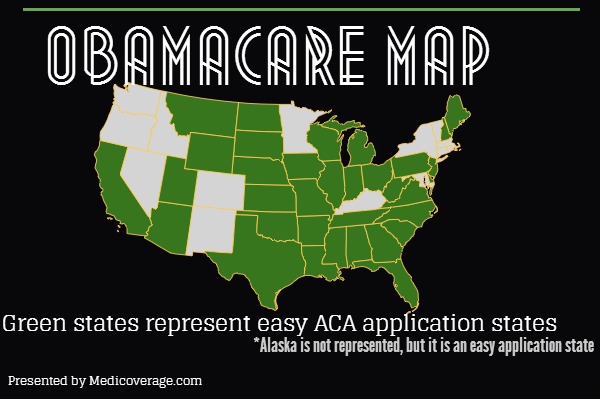

As you have probably heard, the ObamaCare website has had some serious glitches, but now there is a way to avoid all that. Medicoverage announced today that they are able to quickly submit paper applications for ACA Bronze, Silver, Gold, and Platinum plans in most states.

ObamaCare ACA Paper Application

The Affordable Care Act paper application is now available for individuals and families in the following states. This is the easiest way to apply for health coverage. Click on your state below to access the application.

Alabama ObamaCare Application

Alaska ObamaCare Application

Arizona ObamaCare Application

Arkansas ObamaCare Application

California ObamaCare Application

Delaware ObamaCare Application

Florida ObamaCare Application

Georgia ObamaCare Application

Indiana ObamaCare Application

Illinois ObamaCare Application

Iowa ObamaCare Application

Kansas ObamaCare Application

Louisiana ObamaCare Application

Maine ObamaCare Application

Michigan ObamaCare Application

Mississippi ObamaCare Application

Missouri ObamaCare Application

Montana ObamaCare Application

Nebraska ObamaCare Application

New Hampshire ObamaCare Application

New Jersey ObamaCare Application

North Carolina ObamaCare Application

North Dakota ObamaCare Application

Ohio ObamaCare Application

Oklahoma ObamaCare Application

Pennsylvania ObamaCare Application

South Carolina ObamaCare Application

South Dakota ObamaCare Application

Tennessee ObamaCare Application

Texas ObamaCare Application

Utah ObamaCare Application

Virginia ObamaCare Application

West Virginia ObamaCare Application

Wisconsin ObamaCare Application

Wyoming ObamaCare Application

Need Assistance filling out the Application?

You can call an agent to receive help while filling out the app or selecting the right plan by calling 800-930-7956. We are here to help you. Many people don’t realize that there is no fee to work with an agent. With our help and the new paper application you won’t experience the ObamaCare website timing out nor the long wait times for hotline assistance (apparently reported up to 45 mins!). And, not to worry, you will be still be eligible for ObamaCare subsidies if you qualify.

When you’re done with your application fax it to 310-765-4136 or mail it to the address on the cover sheet of your application.

ACA: Fed SHOP Delay, Small Businesses Enroll Through Agents

November 30, 2013 By Amy De Vore+

Healthcare.gov delayed the Affordable Care Act federal SHOP* exchanges purchased through their site till 2015. However, small businesses, if they qualify, may still receive SHOP tax credits when they enroll through insurance agents or brokers for the new ObamaCare small business plans.

*SHOP stands for Small Business Health Option.

This is just one of many delays, including the employer requirement that employers with 50 or more full-time equivalent employees must offer insurance or face a penalty. This was also delayed until 2015.

SHOP Employers Enroll Through Agents

Agents, like the team at Medicoverage, will be able to help employers find a plan(s) and enroll them, even though they cannot use the federal website. For employers to get an idea of plans click here to see the individual and family ACA Bronze, Silver, Gold, and Platinum plans available. Employers will need to contact their agent directly at 800-930-7956 to find out what works best for them.

If Your Employer Chooses Not to Enroll in SHOP

If you are an employee who will not receive job-based health insurance you are still mandated to have health insurance or pay an ACA penalty (tax). If you need your own health insurance go to HealthApplication.com to fill out your individual or family application. Once you send in this application your agent will inform whether you are eligible for federal subsidies and explain the plans to you.

Remember before you do anything, check with your employer to see if they enroll you in a plan. If your employer offers you qualifying insurance you cannot receive subsidies. For further questions contact Medicoverage.

Fed’s ACA Website Will Not Be Fixed by Dec 1st, CMS Says

November 27, 2013 By Katie Banks+

The federal website, Healthcare.gov, “will not work perfectly on Dec. 1,” per CMS spokesperson, Julie Bataille. The spokesperson went on to say, “periods of suboptimal performance” will still be present due to high traffic and technical difficulties, according to The John and Rusty Report.

The website has been plagued with long wait times and the system timing out when people try to apply for one the new ACA plans: Bronze, Silver, Gold, and Platinum. Bataille’s announcement came after the federal website had an unexpected one hour outage on Monday, November 25, 2013.

How to Avoid the Federal Website

Many people may not realize that they do not have to use the federal website to be insured and receive federal subsidies on January 1, 2014. Agents and brokers are able to help people enroll in plans without the consumer having to go onto the fed’s site. All federal applications should be in as early as possible to have coverage on January 1, 2014. Below you will find the application:

At anytime if you have a question while filling out your application or to learn about which plan is right for you call 800-930-7956 or contact Medicoverage.

ObamaCare: Federal Enrollment Extended Till Dec 23rd

November 27, 2013 By Ray Wilson+

The federally run Obamacare plans have received an extension till December 23, 2013 for a January 1, 2014 start date. This gives consumers in those states an extra 8 days to decide on one of the new Bronze, Silver, Gold, or Platinum plans.

ACA Applications

Go to Healthapplication.com to get your paper application. Once you fill out the application and send it in, you will be contacted to discuss plans and informed if you qualify for subsidies. Remember to fax, scan and email, or snail mail your application in as soon as possible.

To learn if your state has extended its deadline call 800-930-7956 or contact Medicoverage.

Non-ACA plans for Anthem CO, GA, NV, VA: Enroll Til Nov 15th

October 29, 2013 By Katie Banks+

Anthem is allowing residents of Colorado, Georgia, Nevada, and possibly Virginia to enroll in non-Obamacare plans until November 15th. This means that all current clients can renew their current plan for another year, as well as anyone can apply for a December 1, 2014 policy end date.

Anthem Facts for those who want to Enroll in non-ACA plans

There are few things you should know when applying for these plans:

- The premiums may be less expensive

- May have a larger network

- May have added benefits

- These plans do not necessarily cover the ACA essential health benefits

- Preexisting conditions may disqualify you (if enrolling for the first time)

If you live in one of these states and would like to learn about your options call 800-930-7956 or contact Medicoverage.

Virginia Exchange Rates

October 02, 2013 By Amy De Vore+

Virginia has released its Exchange rates for the new Affordable Care Act plans: Bronze, Silver, Gold, and Platinum.

VA Rate Chart

The following chart lists plans and their premiums for different areas of Virginia. However, these plan premiums are only a sample because not every age is listed nor do these prices include premium subsidies. For your specific monthly cost and to find out if you qualify for premium subsidies or cost-sharing subsidies call 800-930-7956 or contact Medicoverage. Scroll to the right to see prices.

Click here for a full-screen view of Virginia’s pricing.

Virginia Platinum Health Insurance Marketplace Plan Details

August 15, 2013 By Amy De Vore+

At this time details of Virginia’s Platinum plan are unavailable. However, due to the Affordable Care Act’s guidelines all Platinum plans are the top tier of all the new plans, with the lowest out-of-pocket maximum, highest monthly premium, and members pay 10% of medical costs the your out-of-pocket max is met. Every new “metal” plan is defined by their metal level. What this means is, each plan must offer a percentage of coverage from 60-90%. All plans much include the ObamaCare 10 essential health benefits and providers must abide by the 80/20 Affordable Care Act Rule, and all new ObamaCare plans have guaranteed issuance.

VA Platinum Details

Since we are waiting on final Virginia plans, we will compare the plans details to two established states: California and Colorado. In Colorado, the Platinum plan deductibles range from $0 to $1,000. Covered California’s has released a breakdown of their Platinum plan, demonstrated in the chart below:

| Benefits

|

Platinum Health Plan*

|

| Deductible

|

$0

|

| Preventive

|

$0

|

| Doctor’s Office Visits

|

$20

|

| Specialist

|

$40

|

| Generic Rx

|

$5 or less

|

| Brand RX

|

$15

|

| Lab Testing

|

$25

|

| X-ray

|

$40

|

| ER Visit

|

$150

|

| Urgent Care

|

$40

|

| Out-of-Pocket Max

|

$4,000/$8,000 (ind/fam)

|

Virginia Platinum Plan Premiums

We’ll say it again, we don’t have their figures at this time, but will update as necessary. Instead, we will offer California’s and Colorado’s premium range to get an idea of rates for what Virginia’s plans may look like. A Platinum Plan for a 40 year old, non-smoker in Colorado has a range of $314 to $499, and in California a range of $285 to $687. These premiums do not include the ObamaCare federal premium subsidies, which can drop the premium significantly. The wide range of rates are based on area and provider. For your specific premium call 800-930-7956.

How Platinum Compares to Different Metal Levels

The Platinum plans have a $0 to low deductible, the lowest out-of-pocket maximums, and members pay only 10% of their medical care. For the reasons stated, it is expected to attract the sickest enrollees. We’ll have to see who enrolls in these plans, but if only the sick enroll the premiums could rise drastically in years to come. Platinum plans offer the strongest coverage, however it is worth looking into a Silver or Gold plan to see if these are a better fit for you with their fairly low deductibles, and lower premiums. Click here to compare the ObamaCare Bronze plan, Silver plan, Gold plan, and Platinum plan side-by-side.

For further questions call the number above or contact Medicoverage.

Virginia Silver Plan Overview

August 14, 2013 By Ray Wilson+

Virginia has yet to release its Silver plan preliminary premiums or plan breakdowns for the up coming initial enrollment period of October 1, 2013. However, all nationwide ObamaCare Silver plans must include the ObamaCare 10 essential health benefits, providers must cover 70% of your medical costs before you hit your out-of-pocket max, and providers must abide by the 80/20 Affordable Care Act Rule, where all insurance companies must spend 80% of the plan premiums on health care or refund their policyholders.

VA Silver Plan Overview

Silver plans offer many benefits before the deductible is satisfied, as well as having he second lowest monthly premium. Since Virginia plans have not been released, below are California’s preliminary breakdown of out-of-pocket costs for the Silver plan for illustrative purposes only.

| Benefits

|

Silver Health Plan*

|

| Deductible

|

$2,000 Med

|

| Preventive

|

$0

|

| Doctor’s Office Visits

|

$45

|

| Specialist

|

$65

|

| Generic Rx

|

$25 or less

|

| Brand RX

|

$50 *after $500 Rx deduct

|

| Lab Testing

|

$45

|

| X-ray

|

$65

|

| ER Visit

|

$250 *after deduct

|

| Urgent Care

|

$90

|

| Out-of-Pocket Max

|

$6,350/$12,700 (ind/fam)

|

Virginia Silver Plan Premiums

Due to the lack of concrete Virginia premiums, we will use California and Colorado’s figures as an example. In California the average Silver premium for a 40 year old, non-smoker is $294, and Colorado’s Silver premiums for a 40 year old, non-smoker range from $245-$475 per month for an individual. These premiums do not include the ObamaCare federal premium subsidies, which can significantly drop the monthly premium . Premiums are based on age and area. For your specific premium call 800-930-7956.

Silver Plans Compared to Other Metal Plans

Silver plans may have the second lowest monthly premium, however it may cost less than the Bronze plan throughout the year. The reason for this is Silver is the only plan that offers ObamaCare cost-sharing subsidies to individuals and families making less than 250% of the poverty line: $28,725 for an individual and $58,875 for a family of four. As well as, if Virginia’s plan breakdowns are similar to California’s, it will cover many services before the deductible is satisfiedClick here to compare the ObamaCare Bronze plan, Silver plan, Gold plan, and Platinum plan side-by-side.

For further questions call the number above or contact Medicoverage.

ObamaCare: Virginia Gold Plan Overview

August 14, 2013 By Katie Banks+

With ObamaCare’s initial enrollment fast approaching Virginia’s Gold plan premiums are still not official. However all Gold plans much include the ObamaCare 10 essential health benefits, your insurance provider must pay 80% of your medical costs while you pay 20% until you meet your out-of-pocket max, and insurance companies must abide by the 80/20 ObamaCare Rule, where providers must spend 80% of their policyholders’ aggregate plan premiums on health care or refund their policyholders.

Virginia Gold Plan Details

Since we do not know Virginia’s Gold plan breakdown, we will use California and Colorado as an example of how Virginia’s plans may work. Colorado Gold plan deductibles range from $0 -$2,000, while the chart below is an example of a California Gold plan. The chart below is just for comparison:

| Benefits

|

Gold Health Plan*

|

| Deductible

|

$0

|

| Preventive

|

$0

|

| Doctor’s Office Visits

|

$30

|

| Specialist

|

$50

|

| Generic Rx

|

$25 or less

|

| Brand RX

|

$50

|

| Lab Testing

|

$35

|

| X-ray

|

$50

|

| ER Visit

|

$250

|

| Urgent Care

|

$60

|

| Out-of-Pocket Max

|

$6,350/$12,700 (ind/fam)

|

Virginia: Gold Plan Premiums

While the state’s plans are being approved, again, we will use Colorado and California as an example. In Colorado the Gold premium for a 40 year old, non-smoker range from about $287 to $551 per month, and in California the premium ranges from $370 to $600. These figures do not include the ObamaCare federal premium subsidies, which can drop the premium significantly. Remember premiums are based off age, area, and provider. For your specific premium call 800-930-7956.

Gold Plan Differs from Other Metal Plans

The Gold plan has the second highest premium, with, generally, the same out-of-pocket costs as the Bronze and Silver plan. With the Gold plan you pay 20% in coinsurance, copays, deductibles, while the plan pays out 80% toward your medical costs until you meet your out-of-pocket max. Once that is satisfied you don’t pay anything else until the next year. The Gold plan could end up saving you money even over the lowest premium plan, the Bronze plan, because with the Gold plan your provider should start paying toward medical services even before the deductible is satisfied. Click here to compare the ObamaCare Bronze plan, Silver plan, Gold plan, and Platinum plan side-by-side.

For further questions call the number above or contact Medicoverage.

Bronze ObamaCare Plan: Virginia

August 13, 2013 By Ray Wilson+

Virginia defaulted to a federal exchange to comply with ObamaCare. Most states that defaulted to federal have not provided concrete plans or premiums. The Bronze plan, which is lowest tiered model of the ObamaCare plans, still must include all theObamaCare essential health benefits, and at minimum cover 60% of overall medical costs. Bronze plans should have the lowest monthly premium*.

*Some job-based plans may actually offer lower Silver plan premiums than Bronze.

Virginia Bronze Plans

The information in this article is dedicated to individual and family plans. Click here to learn about how the Bronze plan works for group and small businesses under ObamaCare.

These plans must offer a 60/40 split with your insurance company covering 60% of your medical care. All new metal plans must follow the 80/20 ObamaCare Rule, which states that 80% or plan premiums must be spent on medical care.

Virginia Bronze Rates

As of now, we were unable to find concrete Virginia figures. Therefore we have provided an example of California’s rates and premiums, since they were the first to release their figures. An example: California’s average Bronze plan for a 40-year-old, non-smoker is $226 per month, without ObamaCare premium subsidies. If this same person were to qualify for subsidies s/he could pay as low as $0 per month in premiums. Below is a chart of California’s figures to give an idea of how a Bronze plan may work in Virginia:

| Benefits

|

Bronze Health Plan

|

| Deductible

|

$5,000 Med/Rx

|

| Preventive

|

$0

|

| Doctor’s Office Visits

|

$60 per first 3

|

| Specialist

|

$70 after deduct

|

| Generic Rx

|

$25 or less after deduct

|

| Brand RX

|

$50 after deductible

|

| Lab Testing

|

30% after deduct

|

| X-ray

|

30% after deduct

|

| ER Visit

|

$300 after deduct

|

| Urgent Care

|

$120 after deduct

|

| Out-of-Pocket Max

|

$6,350/$12,700 (ind/fam)

|

For the most up-to-date Virginia premiums and plan rates call 800-930-7956.

Virginias Bronze Plan May Not Be Best Deal

Many people will see the lower price tag and think Bronze is the right plan for them, however Bronze plans usually have the highest deductible, and the deductible must be satisfied before the insurance company pays toward your coverage. The Bronze plan could actually cost you more for basic care. Make sure to weigh your options before choosing a plan. Also, Silver is the only plan that offers ObamaCare cost-sharing subsidies to help with the costs of deductibles, coinsurance, and copays. Click here to compare Bronze Plan, Silver Plan, Gold Plan, and the Platinum Plan side-by-side.

For any questions or assistance in applying (initial enrollment runs from October 1, 2013 to March 31, 2014), please contact Medicoverage.

How the Affordable Care Act Helps the Uninsured

May 31, 2013 By Amy De Vore+

The Affordable Care Act helps the uninsured in a few ways. For instance, in the LA Times today there was an article about a woman making $12.68 an hour, mother of one child, lives in Los Angeles, and recently choose to forego surgery because she was uninsured. As of January 1st this woman would have options for health coverage.

How the Affordable Care Act Helps Uninsured

She isn’t qualified for Medicaid, however since she works she may qualify for job-based insurance as 2015. Until then and if her employer doesn’t offer insurance she would qualify for premium subsidies and cost-sharing subsidies, and her daughter would qualify for Medi-Cal.

Costs for Lower-Income Families

The article doesn’t state how old she is, but if she is 30, her Silver plan premium could be as low as $93 a month and her deductible would be reduced from $2000 to $500, and a reduced maximum out of pocket from $6,350 to $2,250. This would apply to any single parent to one child living in the Los Angeles area, making her salary.

How do Lower-Income Families and Individuals Get Insurance?

First, it’s important to remember for anyone purchasing a plan from the Health Insurance Marketplace you need your W2 paperwork and financial information handy like child support, alimony, assets. Then you can either go directly through your state’s newly established call center’s navigators or you can go through your insurance agent. Many don’t realize that agents can help with on and off-Exchange plans.

Lower Income Seniors

Seniors do not have to do anything as of January 1st. Seniors stay on Medicare and do not apply for the new metal plans. Make sure your friends and parents are aware that there is nothing for them to do, because states are vocally expressing their concerns about seniors being tricked by scammers into giving away personal information due to the lack of awareness in regards to the ACA.

To learn if you qualify for a subsidy call 800-930-7956 or contact Medicoverage.