Affordable Care Act: Penalties for the Uninsured

An Obamacare penalty will be assessed for those who do not have health insurance and don’t qualify for an exemption.

How are Penalties Assessed?

Affordable Care Act penalties are assessed by the amount of months that a person is without health insurance. For instance, if you didn’t have health insurance for six months out of twelve a prorated amount will be tacked on when you do your taxes (50%).

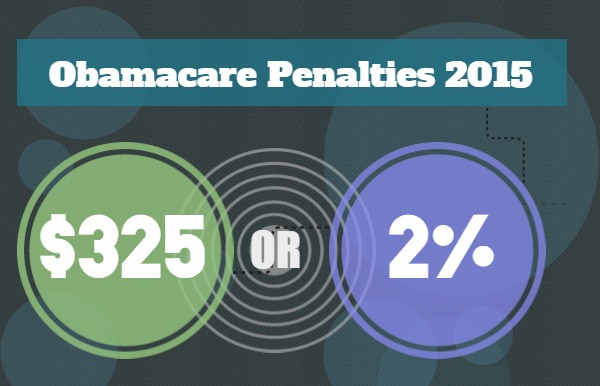

How Much is the Obamacare Penalty

The Obamacare penalty for 2015 is $325 or 2% of your income, whichever is higher. For example if your individual income was $60,000, your penalty would be $1,200 for the year. There is also a penalty for each child that is not covered at $162.50 per child, for an out of pocket max for family at $975. To learn what your specific monthly premium under the Affordable Care Act would be call 800.930.7956.

ObamaCare Penalty Exemptions

Some people will not be responsible for an ObamaCare penalty. Here are some examples of Obamacare exemptions:

- Being below the poverty line, low enough that you don’t file a tax return

- Against your religious beliefs

- In jail or prison

- A member of an Indian tribe

- An undocumented immigrant

- Minimum coverage would exceed 8% of your income

- Live abroad for more than 330 days of the year

- Without health insurance for less than 3 months

For any further questions about Obamacare penalties call 800.930.7956 or contact Medicoverage about ObamaCare.

Comments and Questions

Click to leave a CommentComment from Charles on June 11, 2013

It’s a TAX not a penalty!